are union dues tax deductible in ontario

Union membership contributes to improving your workplace your rights higher wages link to. Californias proposed Workers Tax Fairness Credit would be the countrys first tax credit for union dues.

Getting Paid For Your Work Ppt Video Online Download

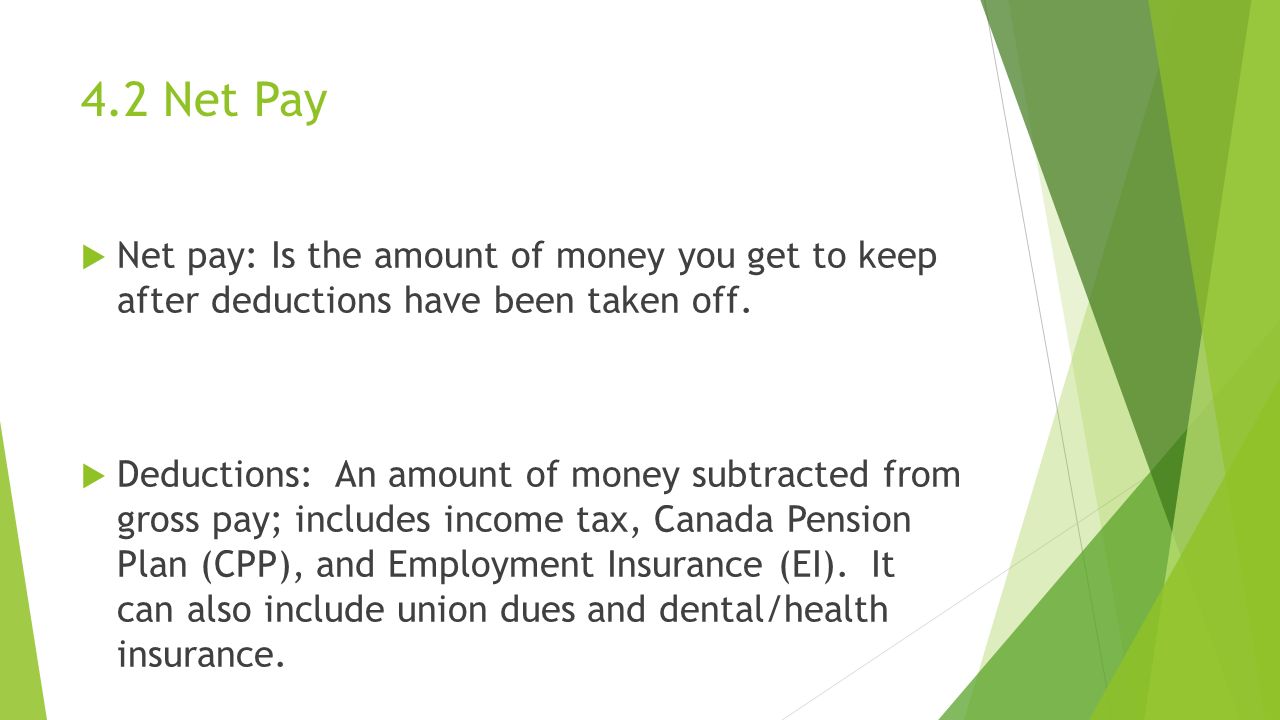

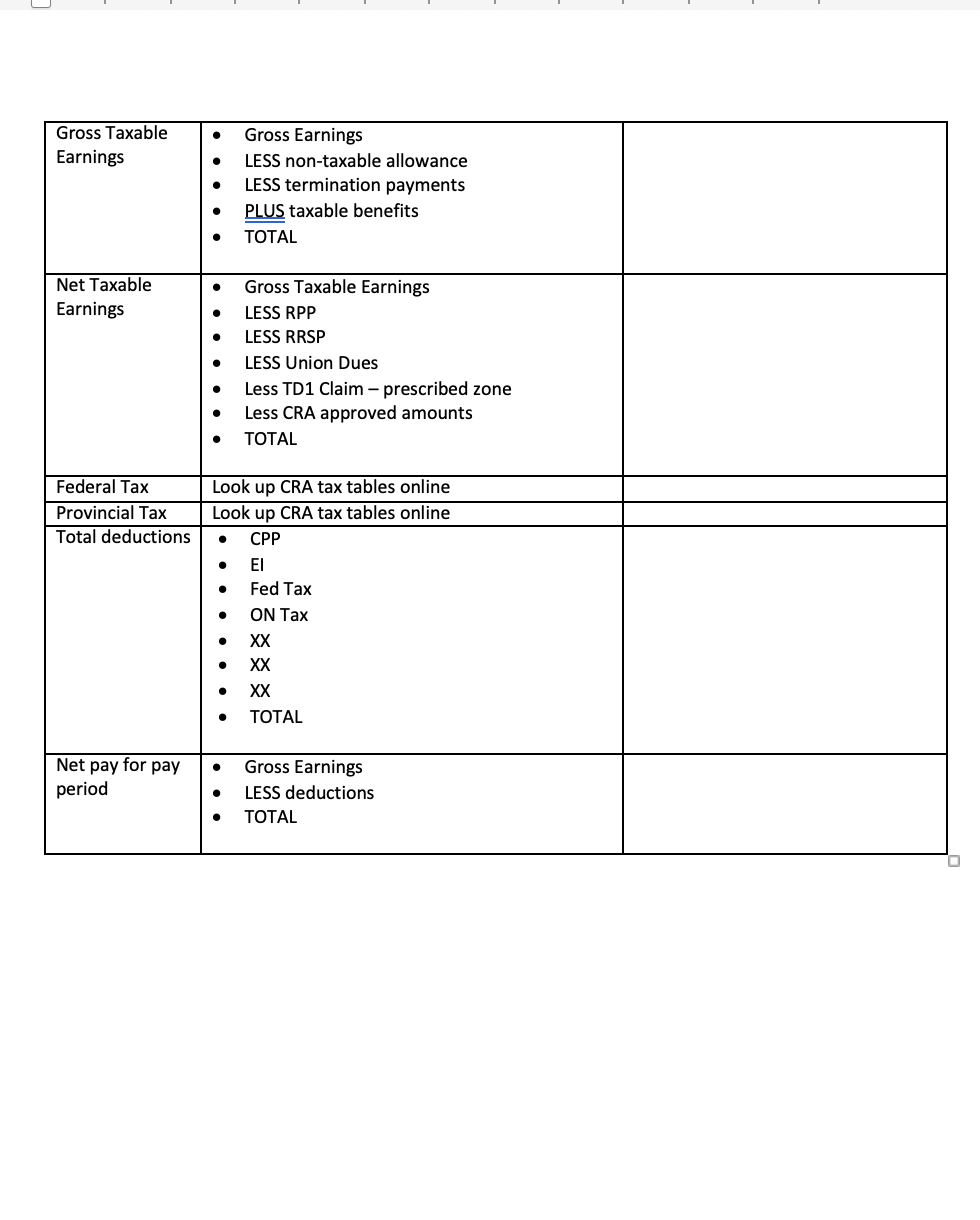

The result is the net income.

. The 2018 Tax Reform Act changed. There are no initiation fees dues are tax deductible and you do not pay any union dues until you have bargained your first collective agreement. These benefits could be higher.

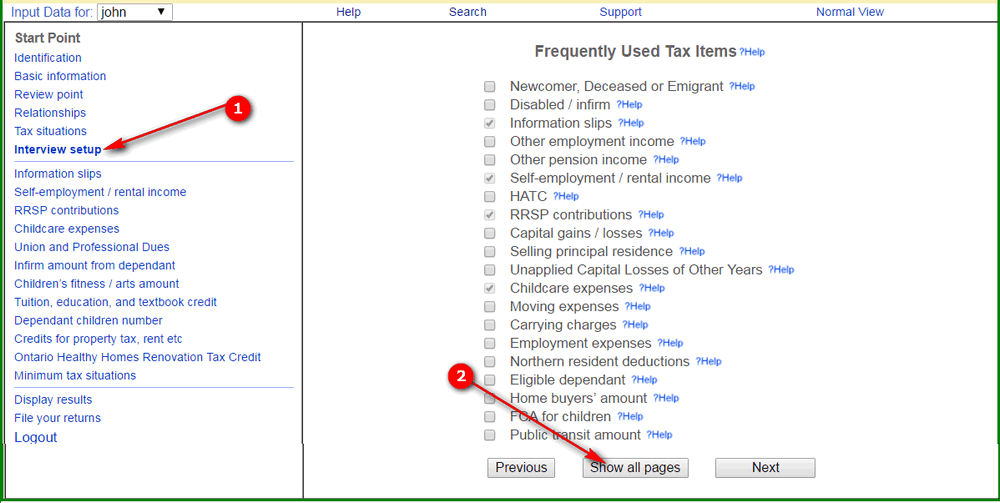

The amount of union fees you can claim is listed in box 44 of your T4 tickets or receipts and includes any GSTHST you have paid. You can claim these amounts as a tax. The answer to your question is that the deduction for union dues and all employee expenses has been eliminated for tax years 2018 through 2025 regardless of whether an.

Calculate the maximum support. Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your. Only union membership dues are deductible and union members may not deduct initiation fees licenses.

By Isabel Blank September 7 2022 News. Union dues deduction clauses on the other hand are the norm. ONA Dues Tax Treatment.

To claim your dues they must be necessary for you to maintain professional standing. Union Dues in Detail. Subtract all statutory deductions including.

Ontario Nurses Association ONA members pay a flat rate based on their hourly rate of pay. They require the employer to deduct union dues from all of the bargaining unit employees in the same way that. Straight Time Hourly Rate.

The effective date of the appointment is used to establish when to start or amend the deduction of union dues when a position is reclassified. The simple math for every 100000 you earn your dues are just 1375. If the CRA asks for proof of which union your dues were paid to contact the payroll department of your employer and request a brief letter stating that they remitted the dues to MoveUP in 2013.

You can deduct dues and initiation fees you pay for union membership as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized Deductions. Union dues membership fees are tax deductible because they are a work-related expense. Total Deducted Per Month.

Union dues ensure that employees compulsorily pay for the benefits they get out of bargaining or negotiation power of unions. Prior to 2018 an employee who paid union dues may have been able to deduct their dues as unreimbursed employee business expenses. This means that you do not have to pay any income tax on the amount equal to your dues.

The simple math for every. Line 21200 was line 212 before tax year 2019. Therefore union dues may have to.

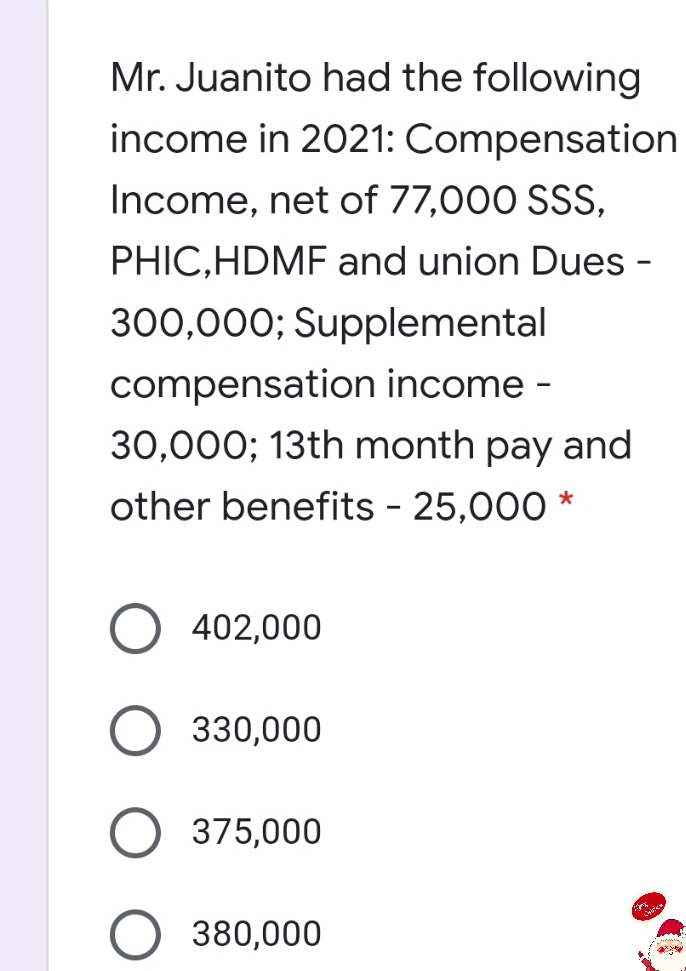

Answered Mr Juanito Had The Following Income In Bartleby

Your Union Dues Plain And Simple

Payroll Deductions How Much Should You Be Paying Enkel

Top 25 Small Business Tax Deductions Small Business Trends

Mathematics For Work And Everyday Life

Qualified Teacher And Educator Tax Deductions 2021 Returns

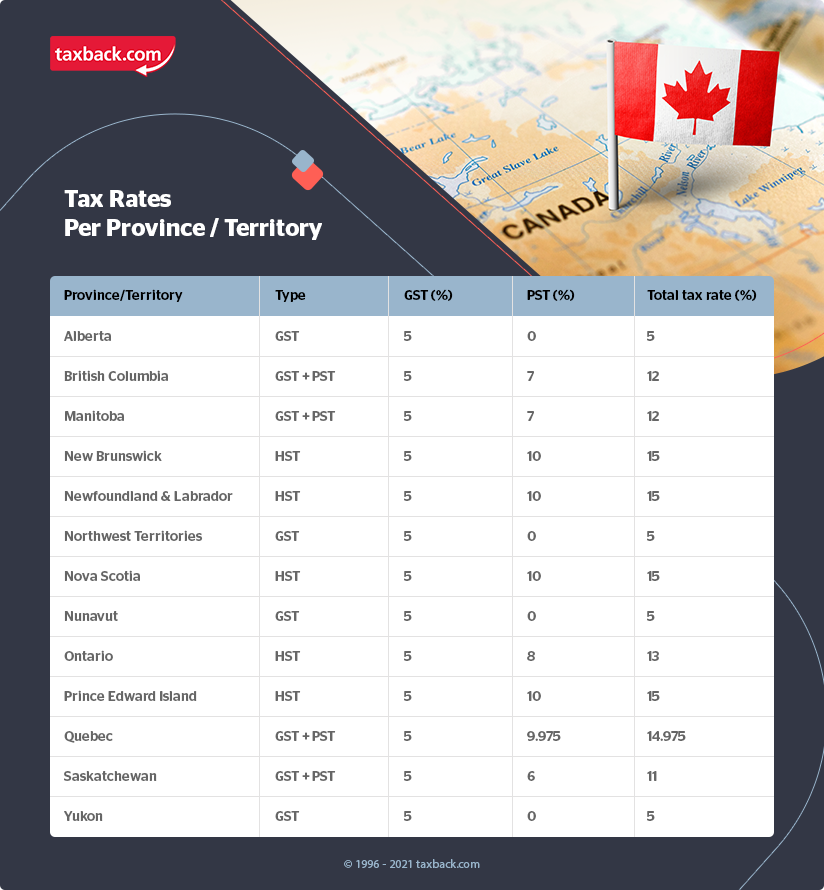

Your Bullsh T Free Guide To Canadian Tax For Working Holidaymakers

Union Dues Are Tax Deductible At Source In All Jurisdictions Except Qb This Course Hero

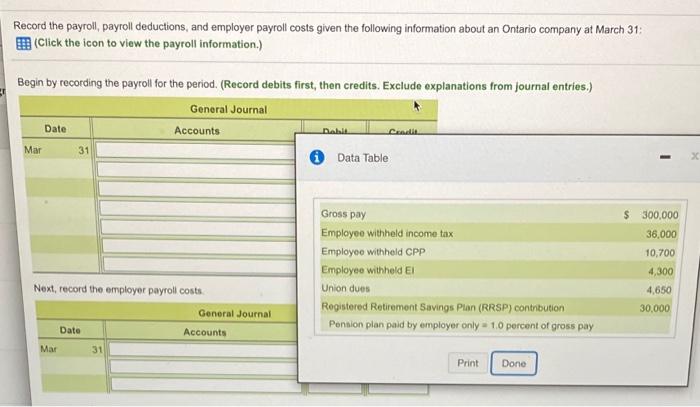

Solved Record The Payroll Payroll Deductions And Employer Chegg Com

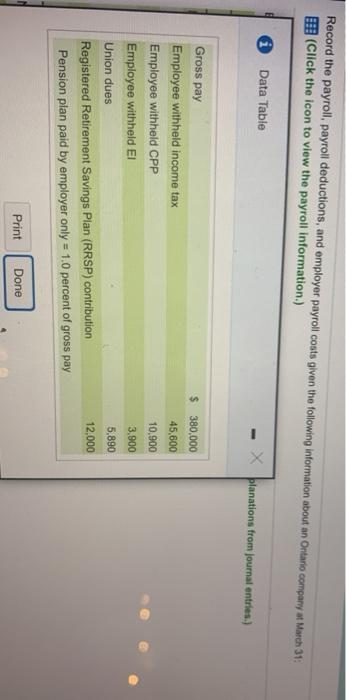

Solved Record The Payroll Payroll Deductions And Employer Chegg Com

Give Your Union A Dues Checkup Labor Notes

Tax Tips Every Nurse Should Know Joyce University

Few Accounting Questions Course Hero

Mathematics For Work And Everyday Life

Union Dues Imagine Better Work

Hemal Thomas Is An Employee In Ontario The Net Pay Chegg Com